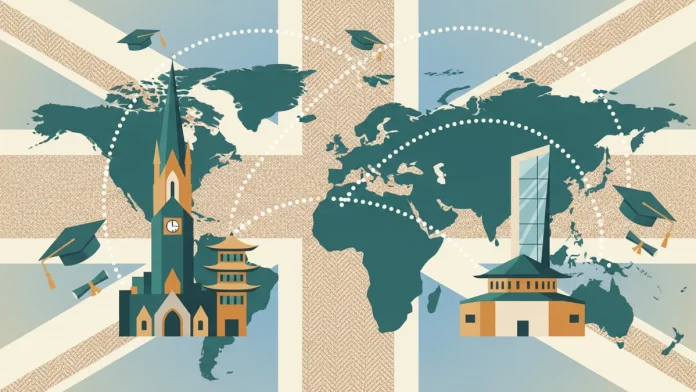

British universities are teaching more students overseas than ever before. In some parts of Asia, Africa, and the Middle East, a UK degree can now be earned without ever setting foot in Britain. Lecture halls are local. Tutors are local. The certificate, though, still carries a British crest. And demand keeps rising.

What’s striking is the scale. Offshore enrolments through transnational education now sit at roughly four-fifths of the number of international students who actually travel to the UK. For university leaders, this isn’t a side project anymore. It’s a core part of how institutions survive, grow, and stay visible in a crowded global market.

But the boom raises an awkward question. Who exactly is driving this demand? Is it the global pull of elite British universities, or something broader and more diffuse?

On paper, you might expect the biggest names to dominate. Oxford. Cambridge. The Russell Group brands that appear high in global rankings and attract students willing to pay for prestige. In reality, they play a surprisingly small role in offshore teaching. These universities still focus heavily on bringing students to the UK, where they can control admissions, teaching, and reputation more tightly. Offshore programmes exist, but they’re cautious and limited.

The heavy lifting is done elsewhere. Post-1992 universities, and many older institutions outside the elite circle, are far more active overseas. For some, offshore students outnumber international students on UK campuses by a wide margin. Bachelor’s programmes lead the charge. They’re cheaper to run, easier to replicate through partnerships, and meet strong demand in countries where studying abroad remains financially or politically difficult.

Talk to students enrolled in these programmes and the motivations sound familiar. They want a British qualification, but without visa uncertainty, high living costs, or cultural dislocation. Employers at home still value “UK degree” as a signal, even if the institution awarding it isn’t globally famous. For many families, that label alone is enough.

This is where the story gets interesting. The data suggest that what sells isn’t so much the individual university as the idea of British higher education itself. The system’s reputation does a lot of quiet work. It smooths over internal hierarchies. It makes programmes from less prestigious institutions feel safer, more credible, more exportable.

Delivery formats reflect this too. Collaborative and franchised models now dominate offshore provision. They’re flexible, scalable, and relatively low risk for universities without deep pockets. Higher-status institutions, again, tend to keep their distance, wary of diluting their brand through arrangements they don’t fully control.

Doctoral programmes tell a slightly different story, but they remain niche. They’re small in number and often led by mid-tier universities with strong research ambitions, rather than global fame. Even here, scale is limited.

On the ground, this reshaping of British education feels pragmatic rather than ideological. Universities diversify because they have to. Students enrol because it works for their lives. The prestige flows from the flag on the degree, not always the name printed beneath it.

The longer-term question is whether that collective reputation can hold. If most growth comes from institutions under financial pressure, operating at distance, with uneven oversight, the system’s brand may eventually feel the strain. For now, though, British transnational education thrives on a quiet paradox: the global power of a national reputation, sustained largely by universities that rarely top the rankings but increasingly define how Britain teaches the world.